National Minimum Wage 2021/22 Uk

Capital Gains Tax Calculator 202122. The calculations are based on the assumption of a 40-hour working week and a 52-week year with the exceptions of France 35 hours San Marino 375 hours Belgium 38 hours United Kingdom 381 hours Ireland 39 hours Monaco 39 hours and Germany 391 hours.

Corporation Tax Calculator 202122.

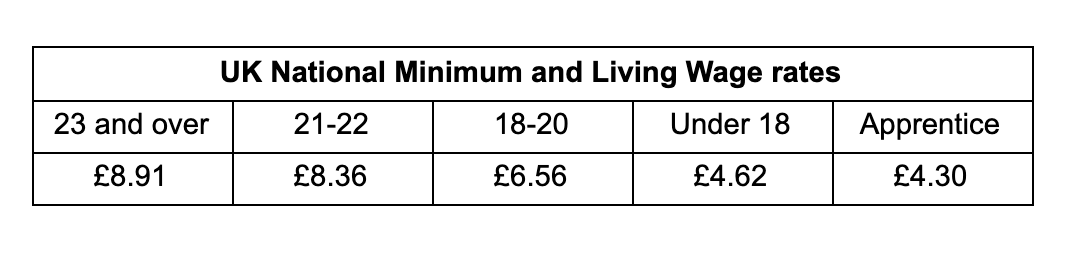

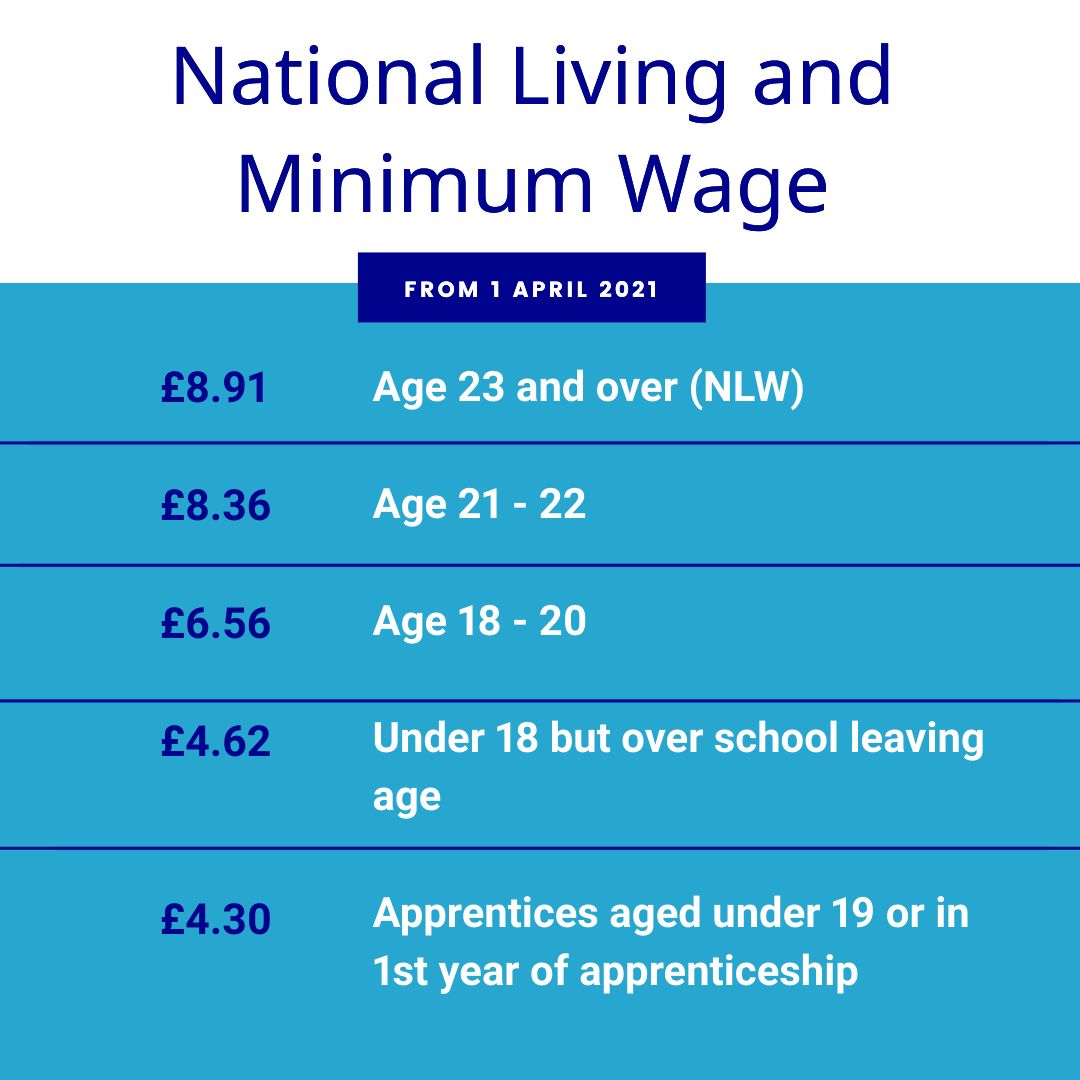

National minimum wage 2021/22 uk. These minimum wage rates are the hourly rate that workers should be paid by their employers depending on their age or whether they are an apprentice. These are also known as voluntary contributions. Keir Starmer has been hit by a shadow cabinet resignation in the middle of his party conference after a row with one of his top team over minimum wage.

We use a public consultation method called MIS to inform the rate. Class 2 NIC are a fixed weekly amount 305 per week for 202122 assuming your profits are above the small profits threshold. If you do not pay either Class 1 NIC or Class 2 NIC and you do not receive National Insurance credits but you want to protect your rights to some state benefits you can pay Class 3 NIC.

BID billing leaflet 202122. 45 of the United States have their own state-wide minimum wage legislation. National minimum and living wage rates.

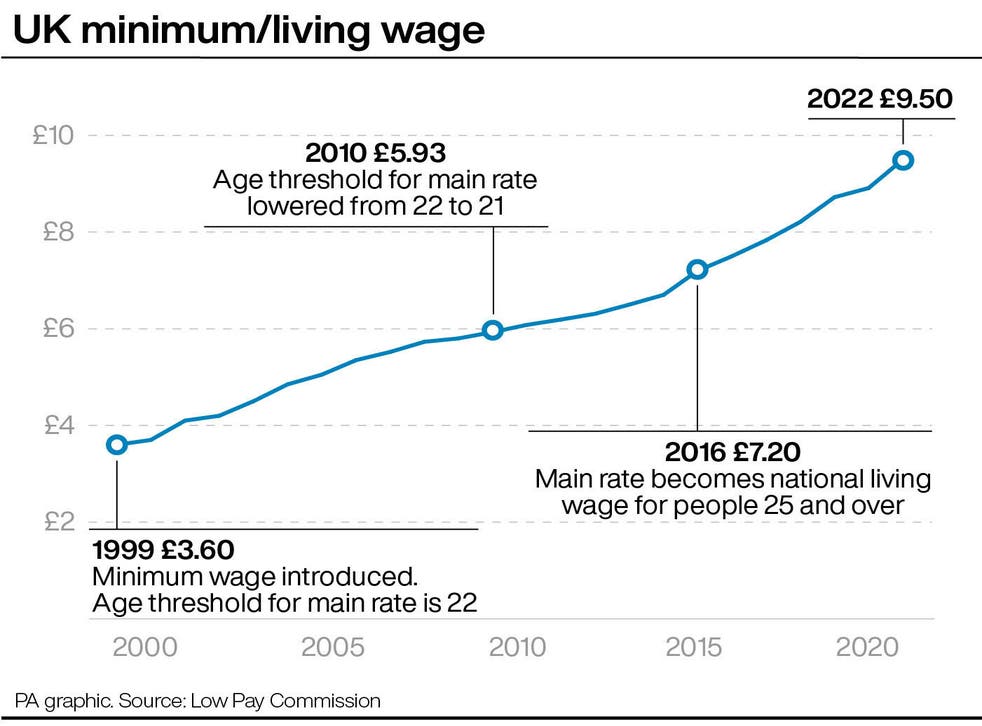

Whichever is the higher of the state minimum wage and the federal minimum wage is the one that. The amount of Class 2 NIC due is based on the number of weeks of self-employment in the tax year. The UK Living Wage for outside of London is currently 950 per hour.

At the meeting UCEA stressed their commitment and that of the employers they represent to New JNCHES and national UK bargaining and shared the list of those HEIs that havesigned up to New JNCHES for 2020-21. The entitlement as expressed applies to five day working patterns. These are set by the governing bodies of each state and they deal with setting the rates and decreeing the laws around minimum wage in their boundary.

Self-employed National Insurance thresholds and bands 2021-22. The following list provides information relating to the minimum wages gross of countries in Europe. MIS asks groups to identify what people need to be able to afford as a.

The minimum rate that local authorities should pay for home care. Calculates your gross and net salary income tax national insurance student loan pension contribution and allowances in 2021-2022. The current minimum wage rates are in effect from 1.

In line with the position set out in the email from the UCEA CEO UCEA commented on the continued uncertainty created by the pandemic and the modelling HEIs are doing for a range of. Small business owners with staff also need to pay employee National Insurance contributions via payroll. So if your self-employment began on 7 February 2022 you should pay 9 weeks Class 2 NIC for 202122 that.

Calculate salary national insurance HMRC tax and net pay UK PAYE Tax Rates and Allowances 202021 This page contains all of the personal income tax changes which were published on the govuk site on Fri 28 Feb 2020. The decision on public sector pay announced by the UK Government in the November 2020 Spending Review is a material factor in setting the 2021-22 pay policy and has an impact on the Scottish Governments financial position. United States Minimum Wage Calculator.

The minimum paid annual leave entitlement is twenty-two days with a further three days after five years of continuous service. Now includes part time salary calculator. The average salary for Apprentices paid by the employers we support is 18996 per week meaning our vacancies are paying 5346 per week on average more than the National Minimum Wage for Apprenticeships.

72 Annual Leave. UK Tax. This is due to the impact of national lockdowns social distancing guidance public health messaging regarding hand hygiene and infection.

However Ministers remain committed to maintaining employment delivering wage growth and a fair rate of pay in the public sector as key levers to aid economic. Impact and performance reports. UK Tax.

In the 202021 season there were extremely low levels of influenza across the UK with an absence of the usual winter spike in rates. Safety and crime. The National Minimum Wage and the National Living Wage in the UK apply to workers in Northern Ireland.

Creative opportunities promotes paid internships and jobs for art design communications and performance graduates and is where employers can access the UKs largest pool of creative candidates. Historical rates tables 2021-22png. This is the minimum rate at which home care agencies can deliver a financially sustainable service and also comply with the National Minimum Wage and National Living Wage.

In 2021-22 the UKHCA recommends that local authorities should pay a minimum of 2143 per hour when they are funding home care services. Compared to an average over the past 5 years the most recent levels were at a record low throughout the flu season. United States Salary Tax Calculator 202122.

A week runs from a Sunday morning to midnight on Saturday. In addition to the federal wage there are rates set in other states. Real Living Wage methodology.

Class 1 National Insurance NI contribution rates for tax year 2020 to 2021 what NI category letters mean. For 202122 the rate of Class 3 NIC is 1540 a week. The National Agreement Part 2 Para 72 will therefore with effect from 1 April 2020 be amended to read as follows.

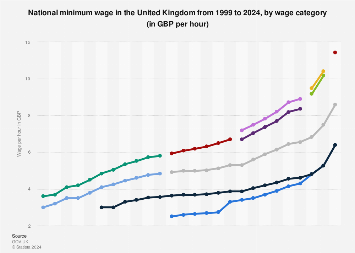

National Minimum Wage and National Living Wage rates change every April. The self-employed usually pay both Class 2 and Class 4 National Insurance through their annual Self Assessment tax return. Busking and Street Collection guidelines.

A real Living Wage. What are Class 3 National Insurance contributions. United States US Tax Brackets Calculator.

National Insurance rates and categories - GOVUK Skip to main content.

National Minimum Wage Rises Optimum Director Salary 2021 22 Haywards Chartered Accountants Wigan

New Tax Year Changes For Employers April 2021 Collins Accountancy

The National Minimum Wage In United Kingdom Study24hours Com

National Minimum Wage Rises Optimum Director Salary 2021 22 Haywards Chartered Accountants Wigan

Statutory And Minimum Pay Infographic Business Law Donut

Minimum Wage 2021 New Uk Rates Revealed In Budget Explained Will It Increase And How Much Is It Currently Edinburgh News

Explaining National Living Wage National Minimum Wage Rates Increases For 2021 The Legal Partners

Uk Minimum Wage 1999 2020 Statista

National Living Wage And National Minimum Wage 2021 22 Chiene Tait

Uk Minimum Wage 1999 2020 Statista

Labour Law Minimum Wages 2021 Around The World Scc Blog

Keep Up To Date This April 6 Key Changes In The World Of Employment Law 2021 Hillyer Mckeown

Ukhca S Minimum Price For Homecare For April 2021 To March 2022 The Ukhca Blog

National Minimum Wage Rises Optimum Director Salary 2021 22 Haywards Chartered Accountants Wigan